Qashio, a UAE-based fintech, raises $10 million to help businesses in Saudi Arabia manage their spending in a cashless economy

Qashio, a UAE-based fintech, has raised $10 million in a seed round, with participation from strategic international and regional investors to accelerate expansion into the Kingdom of Saudi Arabia. The company plans to use the new funding to fuel its growth in the region’s burgeoning financial technology sector.

The seed funding round is supported by global investors such as One Way Ventures (early investors in Brex), MITAA, Cadorna Ventures, as well as regional investors such as Sanabil 500 MENA, Nuwa Capital, Iliad Partners, Phoenix Investments, and strategic family offices and angels. The round consists of both equity and non-equity financing.

Founded in 2021 by seasoned serial entrepreneurs with multiple successful exits, Jonathan Lau and Armin Moradi, Qashio is the first fintech in UAE history to issue employee corporate cards programmatically. Its enterprise-grade spend management platform enables business owners and finance leaders full visibility and control of all expenses. Their dashboard integrates real-time tracking for every business expense and allows enterprises and SMEs to make informed cash flow decisions.

Lex Zhao, Partner at One Way Ventures commented, “The co-founders Armin and Jonathan are a unique combination of deep ERP expertise and have a demonstrated track record of building world-class software products. We’re excited and grateful to join this round and to share our experience as early investors in Chipper Cash and Brex.”

Qashio has brought on seasoned executives and advisors to round out the team: Eric Menorval, well-known CTO from central America banking group Namutek Fintech, has joined to lead the technical development and integrations; Arun Khehar, former SVP at Oracle ECEMEA and Antoine Massad, Former CEO of MAN Group MENA and Majid Al Futtaim Asset Management have recently joined the advisory board, bringing decades of enterprise software expertise and investment network across the region.

Armin Moradi, CEO and co-founder of Qashio commented, “Saudi Arabia is making great efforts to align with its Vision 2030; taking fintech-friendly approaches and bringing more fintech firms into the market. At Qashio, we are proud to be an integral part of propelling a cashless society in the UAE and now KSA. We are committed to helping companies move away from all those manual finance processes and get more visibility and control by providing a secure, safe solution that is ready for enterprise-grade deployment as well as SMEs.

Jonathan Lau, CPO and co-founder of Qashio said, “We’re grateful to all our investors and advisors for their support on our expansion into the largest country in the Middle East. This round of funding will help us to expand hiring and growth into Saudi Arabia and other parts of the GCC as well as accelerate the execution of the product roadmap. We are excited for the days ahead.”

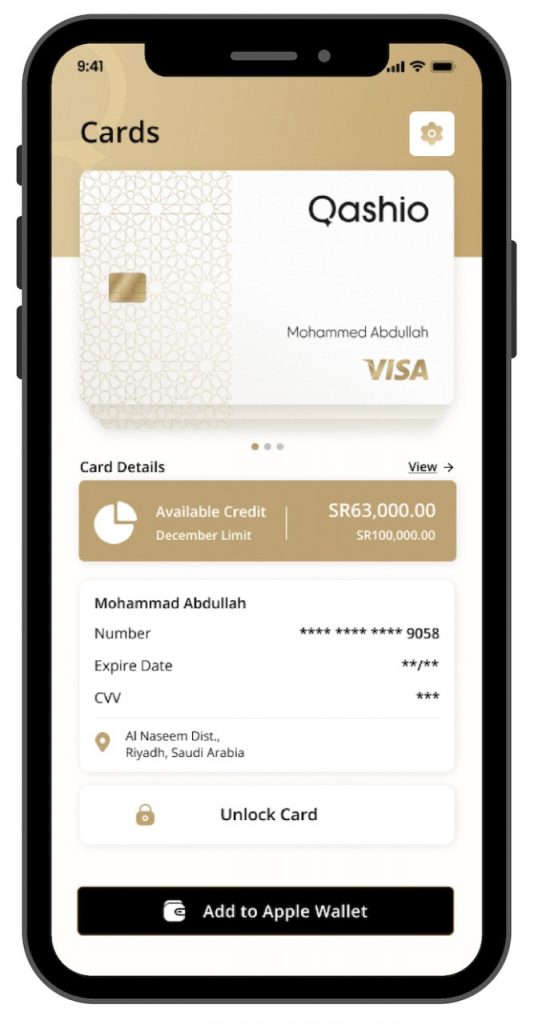

The Qashio virtual and physical cards, when combined with the accompanying software, provide businesses with a more streamlined way to manage their spending. This can lead to significant savings in terms of both time and money, as finance and HR departments are able to better track expenses, cash flow, and employee spending.

Qashio has signed renowned brands and customers across KSA and UAE and continues to onboard clients. These include well-known brands such as Nana, Swiss International, Yaa Foods, Al Shiha Group, Tasoru Holding, Instashop, Saif Belhasa, EFS Facilities Management Services Group, Papa Johns, Bulldozer Group, etc. Qashio is the winner of the Gulf Capital FinTech Business Solution of the Year 2022.

With Qashio, business owners, CFOs, HR Leaders and finance teams can set spending limits on virtual & physical cards issued in seconds, and limit and control spend categories and vendors. This eliminates the use of cash, avoids late expense claims, reduces the amount of work put into reimbursements and ultimately replaces manual invoicing and vendor /supplier payment.

Mastercard’s report on ‘The Future of Fintech’ revealed that most of the fintech funding deals (32%) and funding capital (49%) across MENA in 2021 was focused on the UAE. The MENA region is expected to have 45 fintech unicorns by 2030 and payments and fund transfers are expected to be the top applications or functions driving fintech growth. Fintech startups in MENA recorded a 183% growth in funding in 2021, the highest rate over the past five years.