Is effective expense management software critical to business success?

Controlling business expenses is one of the biggest headaches faced by CFO’s across different industries in the MENA region. Larger corporations usually have a basic expense management software but it is very reactive, and the controls and verifications happen only after an expense is made. This puts organizations at a risk of a drawn out and often uncoordinated expense reimbursement process. Small and medium sized businesses usually don’t have any software at all. On top of that, it is almost impossible to issue employee credit/debit cards, making reconciliation even more challenging.

According to Hubspot’s 2019 Travel & Expense Management Trends Report, globally 43% of companies still manage expense reports manually, , leaving room for a plethora of errors. In the MENA region, a majority of businesses still use manual CSV processes, paper receipts and handwritten notes to try to track down company expenses and payments.

There is a shocking amount of petty cash leakages, fraud, and errors with reconciliation. Not only are companies managing the actual expenses after they happen, but they also face challenges ensuring that expenses made are within budget and that there are clear policies that are obliged by.

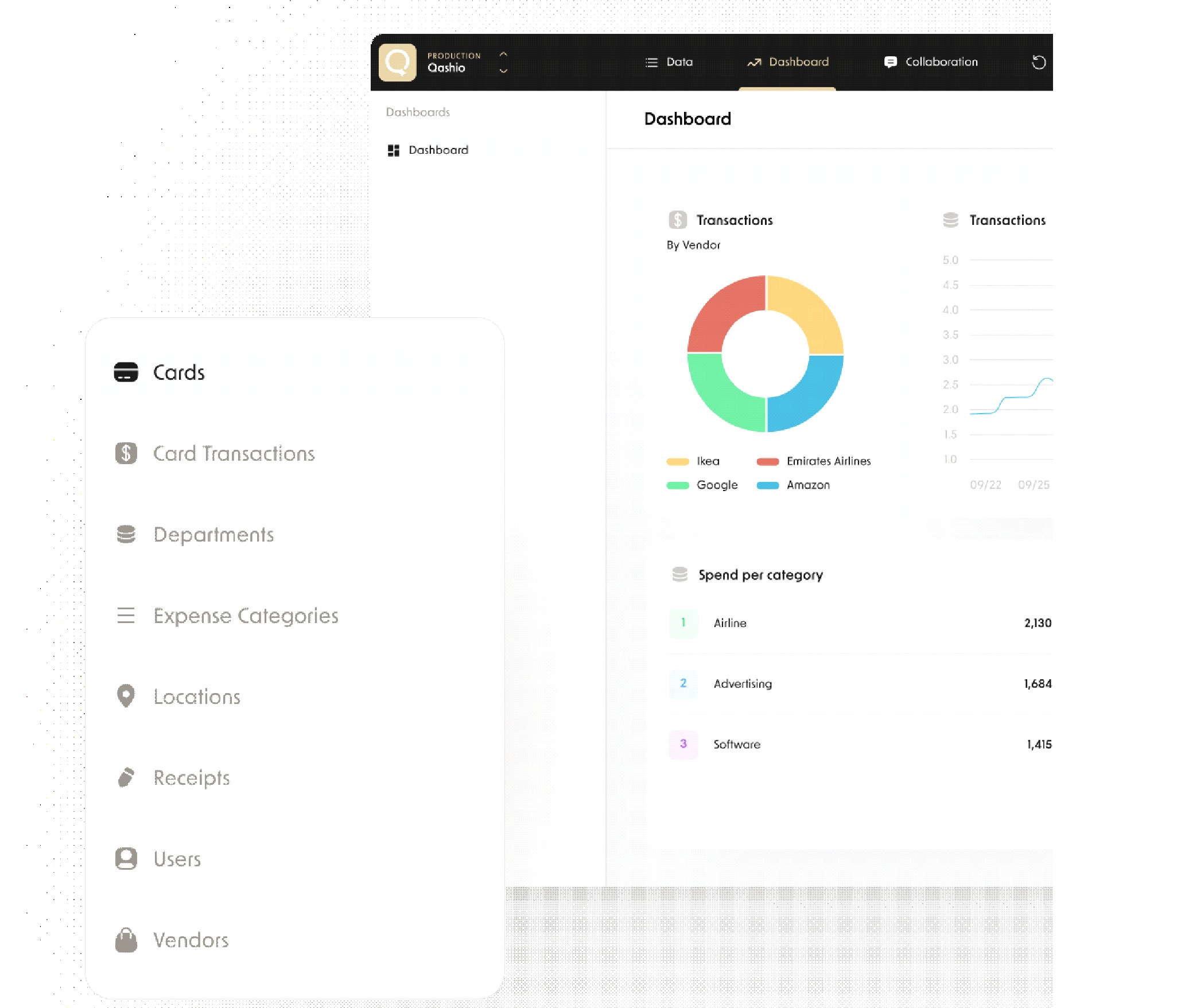

In 2021, there was a seismic shift in the realities of the business world due to the pandemic, and financial operations have now become even more complicated with remote employees, especially for those businesses that don’t have the appropriate tools to facilitate the shift. With an easy to issue and control corporate debit card, as well as full automation in financial and budgeting processes, we at Qashio help businesses with an expense management software tailored to the regional nuances to solve these problems that business leaders face on a daily basis.

We have plans to expand our services to offer invoice management and lines of credit in the near future.

Armin Moradi, Co-founder and CEO at Qashio explains why automation in expense management is the way forward for companies to control their budgets, set department-level approval processes, and view its business expenses in real-time.

- Eliminates error

Manual processes just leave the employee and finance team bogged down by paperwork. Sifting through it ensures that there will be some mistakes as human error is inevitable. A study conducted by the Global Business Travel Association (GBTA) found that processing one expense report costs $58 on average and an additional $52 to correct it. On average, 19% of expense reports have errors. With the software in place, photos of the receipt are uploaded directly into the system, compiled into a report and submitted by the employee.

- Be proactive and set controls

It’s difficult to enforce expense policies if there is no system in place. Some 56% of CFOs in a recent Robert Half Management Resources survey said they have seen an increase in the number of “inappropriate reimbursement submissions” from workers over a three-year period. Qashio allows the finance team to set controls and budgets for each card and employee/department. With software now customizable to a company’s policies, it will flag those expenses that don’t comply, and the team can then approve or reject the transactions in a few clicks.

- Virtual and Physical Cards

Combined with an expense management system, a company can create & close cards, order replacements, change credit limits and more. The card allows for complete transparency of daily transactions and early fraud detection. For example, Qashio’s virtual and physical cards, which are available on-demand for companies, allows finance teams to find and approve transactions easily, set custom limits for employee and vendor cards and match receipts by replying to a text. Another plus point is that companies can issue single-use cards.

- Prevent expense fraud

Expense theft and fraudulent reports are committed by employees who submit reports manually. One survey estimated expense fraud costs U.S. businesses $2.8 billion a year. Automating the process detects duplicate entries and notifies the submitter to combine or erase the expense. These systems also improve transparency by enabling a double review process before reimbursing the expenses, thus narrowing the scope for fraud.

- Faster reimbursements

Automation will speed up the process of approvals and reimbursements. Manual reviews are much more time-consuming, especially if there are multiple approvers involved. By opting for an expense management system, a company can customize their approval workflows and each approver will be notified to complete their part after the previous one has passed it on. Once approved, the reimbursements can be sent out quickly.

- Real-time monitoring and tracking

Expense management systems are key to saving money. With them in place, the finance team will be able to view, analyze and make informed decisions about spending and. Companies can monitor their cash flow and track the firm’s financial performance. They can make adjustments to budget quickly without going through weeks and weeks of manual processes.

- Easy integration with accounting and ERP

Qashio can integrate directly with any accounting system. This superior alternative offers a better way to track expenses and to simplify your reconciliation and budgeting process.

Technology has improved countless business processes and expense management is no exception. Companies are more connected, effective, and efficient than ever. In these uncertain times, flexibility, clarity, and automation are the three keys to expense management success and Qashio’s corporate card and financial control software will help you take control of your business and finances in a way that has never been possible before in this region.