The value of leading Emirati and Saudi brands is growing at a faster rate than global rivals, according to Kantar BrandZ

The value of leading Emirati and Saudi brands has more than doubled in the last two years, outpacing any other global Kantar BrandZ ranking. The value of the Kantar BrandZ 2022 Most Valuable Emirati and Saudi Brands ranking has grown by 110%, helped by consistent investment in infrastructure and the shared goal of economic diversification in the UAE and Saudi Arabia. The rate of growth is well ahead of the next-best performing market, India, which achieved 82% growth in brand value over the last two years.

The no.1 Emirati brand, Etisalat ($11.8 bn) comes from the telecom sector and has rebranded at a group level as e& which is in line with group’s recent positioning as a global technology and investment conglomerate that digitally empowers societies.

STC, the Saudi telecom brand, is the most valuable brand in the overall ranking, increasing its brand value to $16 billion (+66%). The Saudi telecom provider has benefitted from both the rollout of 5G, as well as a major diversification in its offer to include digital payments and entertainment services. The company’s DARE strategy to ‘Digitalize, Accelerate, Reinvent and Expand’ is providing a strong sense of direction and rapid transformation. Digital wallet division STC Pay, for example, became the first digital bank in Saudi in June 2021.

Newcomers to the ranking include newly merged Saudi National Bank (No.2; $15.9bn), which was formed from the merger of National Commercial Bank (NCB) and Samba, real estate brand Aldar (No.22; $725m) and banking brand ADIB (No.29; $457m). Online food-delivery platform Jahez enters at No.18, with a brand value of $1.4bn, and has expanded into new cities and new categories, creating new markets in partnership with grocery and non-food retailers. It has also established PIK, a direct commerce platform, which allows local merchants to reach more consumers. Earlier this year, Jahez was listed on the Saudi Stock Exchange, becoming the first start-up publicly traded in the Kingdom of Saudi Arabia. Retail estate leader Emaar (No.10; $3.0bn) experienced a 67% rise in brand value since 2020, and has developed its reputation for many of the more innovative and distinctive developments across the region.

Amol Ghate, Managing Director, Middle East, North Africa & Pakistan, Insights Division at Kantar commented on the results, “Strong brands are the key to unlocking growth, but this growth happens by design, not by chance. The risers in our current ranking have invested in growing their equity by strengthening their meaningful difference, and then ensuring this is amplified by becoming more salient. Meaningful differentiation comes from creating new categories, expanding footprint or providing greater value for customers. That trajectory is amply demonstrated by brands across different categories in this year’s Kantar BrandZ ranking.”

A broader, growing economic base

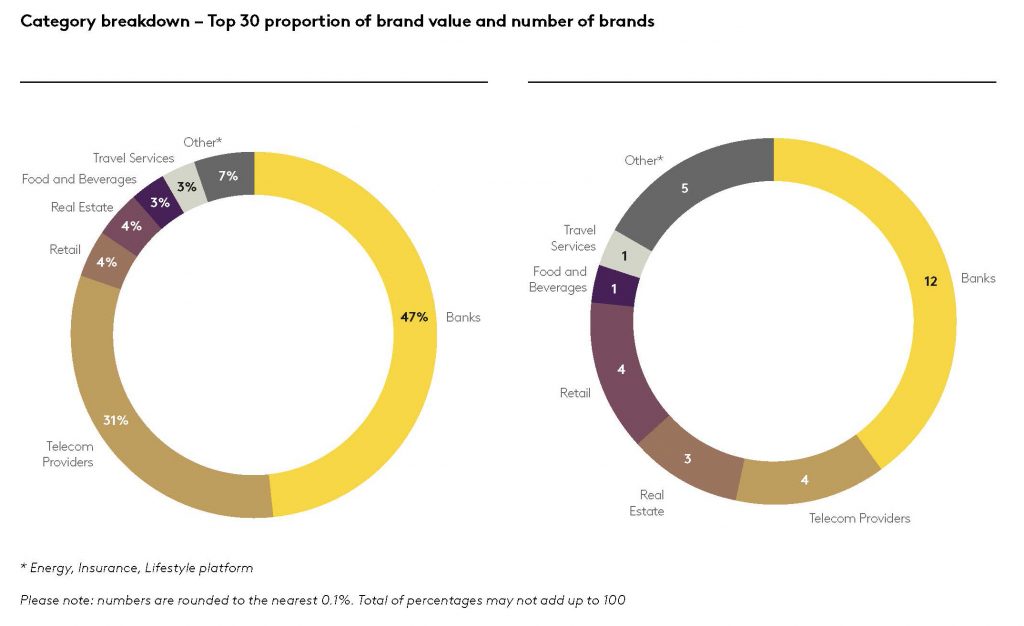

The brand ranking also highlights the broadening of both economies, with new entrants from lifestyle categories, banking and real estate plus a rise of travel brands following the end of the pandemic. The epicentre of growth is the service sector, with banking responsible for 47% of the Top 30’s total brand value after rising by 187% in total category value.

Saudi Arabia’s banking sector saw the fastest risers in the 2022 ranking, with triple-digit growth for the likes of Al Rajhi Bank (No.3; $15.8bn) which was up by 234%, Al Bilad Bank (No.16; $1.4bn, +211%) and Alinma Bank (No.14; $1.7bn, +139%). New entrant Saudi National Bank (SNB) further ups the tally for the category, coming in second overall with a brand value of $15.9 billion. Banking is also the dominant sector amongst Emirati brands with local leaders FAB (No.5; $7.7bn), ADCB (No.19; 1.0bn), Emirates NBD (No. 20 $904m) and Dubai Islamic Bank (No. 26; $619m) showing impressive growth of 97%, 94%, 39% and 96% respectively since the inaugural ranking in 2020.

Impressive rises across a broad range of categories, including real estate, reflect the fact that governments have taken a long-term view on investments such as the Neom sustainable city in Saudi Arabia, and the UAE’s bid to become the region’s arts and cultural hub. This stability has boosted the attractiveness to foreign investors whose continued investment helps create a positive economic outlook, which bodes well for both businesses and brands.

Tourism is also exposing consumers from other parts of the world to local brands from the region, with a host of new attractions, including the Warner Bros. Theme Park in Abu Dhabi and the Amaala Middle East Riviera project, expected to attract millions more tourists to the region.

The Kantar BrandZ Top 10 Most Valuable Emirati Brands 2022

| Rank 2022 | Brand | Category | Brand Value 2022 ($M USD) |

| 1 | Etisalat | Telecom Providers | 11,847 |

| 2 | FAB | Banks | 7,719 |

| 3 | ADNOC | Energy | 3,208 |

| 4 | Emirates | Travel Services | 3,200 |

| 5 | Emaar | Real Estate | 3,043 |

| 6 | Du | Telecom Providers | 2,128 |

| 7 | ADCB | Banks | 1,046 |

| 8 | Emirates NBD | Banks | 904 |

| 9 | Aldar | Real Estate | 725 |

| 10 | Dubai Islamic Bank | Banks | 619 |

The Kantar BrandZ Top 10 Most Valuable Emirati and Saudi Brands 2022 *

| Rank 2022 | Brand | Category | Brand Value 2022 ($M USD) |

| 1 | STC | Telecom Providers | 16,039 |

| 2 | Saudi National Bank | Banks | 15,881 |

| 3 | Al Rajhi Bank | Banks | 15,815 |

| 4 | Etisalat | Telecom Providers | 11,847 |

| 5 | FAB | Banks | 7,719 |

| 6 | Almarai | Food and Beverages | 3,316 |

| 7 | Mobily | Telecom Providers | 3,243 |

| 8 | ADNOC | Energy | 3,208 |

| 9 | Emirates | Travel Services | 3,200 |

| 10 | Emaar | Real Estate | 3,043 |

*Aramco entered the Kantar BrandZ Most Valuable Global Brands Top 100 in 2022 at rank #16. The brand has not been included here since the ranking focuses on brands which are consumer-facing. Regardless of value, any business-to-business brands are outside the scope of this report.

Value still matters

While both markets are booming and consumers are optimistic, value still matters. Consumers are highly attuned to price, but when they feel under pressure, they are likely to gravitate towards brands they already know, particularly if they do not have time to shop around. Justifying prices by delivering high quality products or outstanding service will keep them coming back, or convert one-time buyers.

In the Food and Beverage category, Almarai (No.6; $3.3bn) has built its premium profile by promoting issues such as avoiding food waste in 2021 and becoming the first company in the world to obtain the international certificate for animal wellness for dairy farms and operations earlier this year.

Building such strong perceptions will help brands prepare for any future downturns. Kantar BrandZ research shows that brands that are better able to support higher prices and margins with strong premium grew twice as much as those that did not improve premium perceptions.

Other key trends highlighted in the Kantar BrandZ Emirati and Saudi Top 30 ranking include:

- Ecommerce on the rise post-pandemic: Ecommerce has become a habit for many post-pandemic. Ecommerce in the UAE now accounts for 10% of all retail sales, for example, and the Dubai Chamber of Commerce and Industry forecasts ecommerce to generate $8 billion in sales by 2025, with the vast majority (80% in KSA; 75% in UAE) coming via smartphone. While both online and hybrid retailers have experienced growth, exclusively online players such as HungerStation (No.27; $575m), have grown across all three brand equity pillars of meaning, difference and salience by providing a superior experience, a wide range, and are now acknowledged as specialists by consumers.

- Desire for a healthier lifestyle: Healthier eating options and an increasing interest in exercise were on the rise before the pandemic hit and there has been a renewed focus on the importance of good health. Organic food is seeing a surge in interest, not just among consumers, but also among food producers. The number of organic farms in Saudi Arabia, for instance, is now 17% higher than pre-pandemic, and organic production is up 60%, with the government supporting the sector with marketing support among other initiatives.

- The global sustainability trend is starting to make headwinds in the UAE and Saudi Arabia. In Saudi Arabia particularly, 62% of people say they are personally affected by environmental problems, 54% pay a lot of attention to environmental and social issues in the news, while 56% of consumers are willing to pay a premium for products that are better for the environment. So brands that invest in sustainability now will be ahead of the curve on creating a meaningful difference with their consumers.

The 2022 Kantar BrandZ Most Valuable Emirati and Saudi Brands ranking, report and extensive analysis are available now at https://www.kantar.com/campaigns/brandz/uae-ksa