Dubai real estate at an all-time high after a banner year in 2021

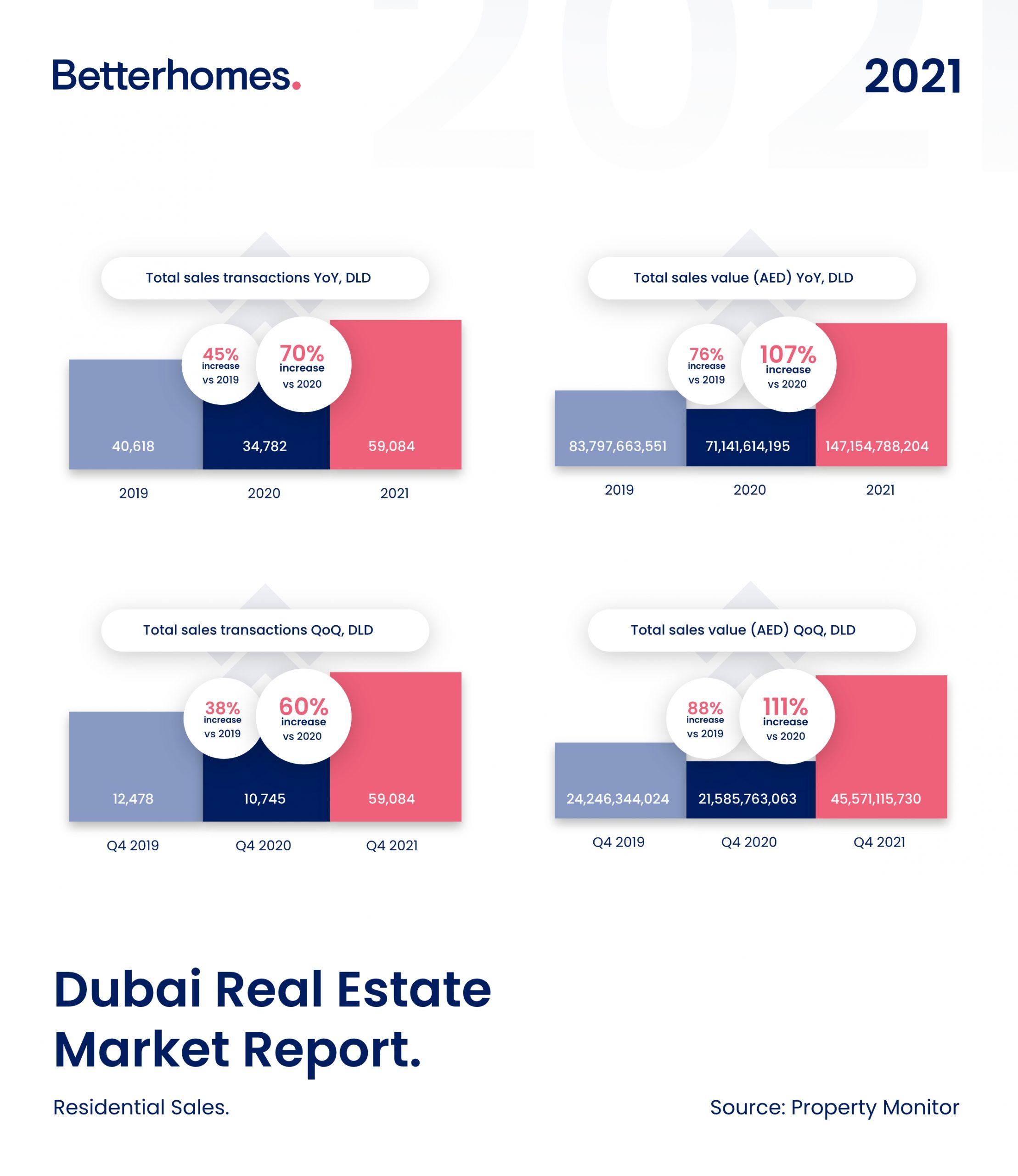

Dubai’s real estate market ended 2021 at a record high with annual growth at its strongest in eight years. Betterhomes’ 2021 Dubai Real Estate Market Report revealed that 2021 concluded with a 70% increase in units sold and a 107% increase in sales value, amounting to AED 147 billion, year-on-year.

Richard Waind, Group Managing Director, said, “The Dubai residential market enjoyed a strong year in 2021 with transactions at an 8-year high and prices in some prime communities surpassing the previous peak set in 2014.”The report pins this remarkable growth primarily on Dubai’s resilient economy and historically low mortgage rates amid the pandemic, resulting in a stronger than ever demand from domestic and international homebuyers last year.“

The UAE government’s continued commitment to attracting talent, business, and high-net-worth individuals to the Emirates has seen a raft of universally welcomed reforms to visa, business, and social rules. All of which helped make Dubai and the UAE the destination of choice for holidaymakers and expats in 2021,” Waind added.

Key findings:

More than just the sales value and volume, several notable trends emerged in 2021. Among them are:

Dubai was a post-pandemic hotspot and haven for investors. Despite the global disruption, Dubai managed to weather the storm better than any other market and buyers were quick to see this. As it staged a strong recovery this year, more investors turned to Dubai’s property market where life and business were minimally impacted.

The interest and need for larger homes continued. What was once viewed as a pandemic-induced trend is fast becoming the new normal as buyers showed a continued preference for homes with office and outdoor space. Villa transactions, in particular, showed a whopping 153% increase YoY.

Sustained demand in Dubai’s prime communities helped push prices up. Gaining the most momentum in median price increase last year was Palm Jumeirah at 65% for villas and townhouses. It was followed by Jumeirah Islands at 55%, and Jumeirah Park at 46%. For apartments, Jumeirah Beach Residence took the lead at 49%, followed by Dubai Creek Harbour, and Dubai Science Park, both at 32%.

The luxury sector picked up with total sales values and transactions climbing at a robust pace. Looking at properties sold and fetching at least AED 10 million, DLD data showed a marked increase at 290% YoY. At Betterhomes, properties sold at this price range was logged at 450%.

COVID-19 impacted buyer behaviour and demographics. Despite Dubai becoming one of few cities that remained open to tourism and trade, activity from foreign investors was ultimately shaped by international protocols and travel restrictions. The top three buyer nationalities at Betterhomes in 2021 showed India at 19%, the United Kingdom at 10%, and Italy at 8%.

Off-plan sales took off despite a slow start to the year. DLD data revealed that off-plan sales boomed in 2021. On a year-on-year basis, the total value of sales increased by 105% while transactions increased by 52%.

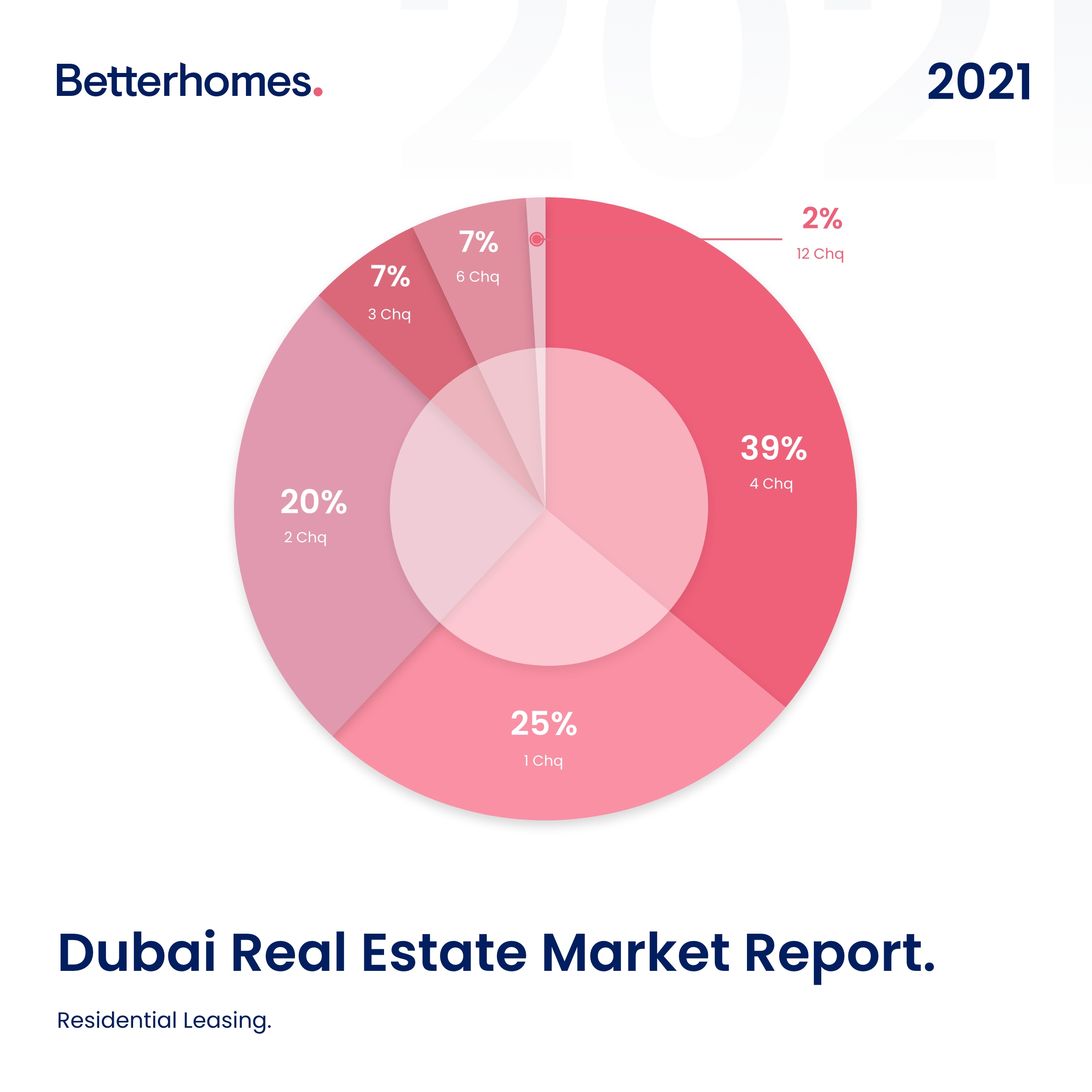

The shortage of properties available for rent pushed rents up. Residential leasing activity continued with a growth of 11% YoY. Betterhomes accounted for the modest growth to the growing gap between supply and demand. According to the report, more properties are being snatched in the market for end-use, further worsening the supply crunch, especially with villas and townhouses.